Do you know ESG reporting has become the new standard in today's business landscape?

In this dynamic world, where the risks surrounding customer relations, climate change, biodiversity, and personal data privacy are rising, ESG reports have emerged as a game-changer.

ESG-related risks can harm the company's reputation and lead to financial problems. Organizations have to report on how their actions affect the community, culture, and the rights of people connected to the company. They also need to show how much they are working to deal with these risks in these three areas.

Investors and stakeholders have recognized the vital role of ESG reports as a pivotal factor in their decision-making processes, be it for investments or other purposes.

According to Gartner:

“85% of the investors consider environmental, social and governance factors when making investment decisions.”

In the ESG report, organizations provide information about how they run their organizational operations and how they strategize to tackle the growing ESG risks. But when it comes to ESG reporting, not all information can be freely disclosed. This is where redaction comes into play.

Certain data must be redacted to protect privacy, comply with regulations, and safeguard confidential business-related information such as financial information.

In this blog, you will get the highlights of ESG reporting, its importance as per laws and regulations and the role of redaction in balancing the disclosure and privacy of information mentioned in the ESG reports.

Exploring the World of ESG Reporting

Before diving deeper into the topic, you need to first understand the concept of ESG reporting.

ESG reporting is a mechanism through which companies disclose their environmental, social, and governance performance to stakeholders. It goes beyond traditional financial reporting and provides insight into a company's impact on various aspects such as climate change, labor practices, diversity and inclusion, board effectiveness, and more.

By measuring and disclosing these factors, ESG reporting allows investors, consumers, and other stakeholders to make informed decisions based on a company's sustainability practices.

The Three Pillars of ESG Report: Environmental, Social, and Governance

ESG reporting revolves around three interconnected pillars: environmental, social, and governance factors, which are as follows:

Environmental Pillar: This pillar focuses on a company's impact on the natural world, including its efforts to mitigate climate change, reduce carbon emissions, conserve resources, and promote sustainable practices.

Social Pillar: The social pillar assesses a company's relationships with its employees, customers, communities, and other stakeholders. It examines aspects such as labor practices, diversity and inclusion, human rights, community engagement, and product safety, along with data protection and privacy policies.

Governance Pillar: The governance pillar evaluates the company's internal structures, policies, and procedures, ensuring transparency, accountability, and ethical decision-making at all levels.

These three pillars provide a comprehensive framework for evaluating a company's sustainable performance, promoting responsible business practices, and driving positive societal and environmental impact.

The Significance of ESG Reporting: Navigating a Changing Landscape

ESG reporting holds significant importance for several reasons. Firstly, it promotes transparency and accountability, enabling stakeholders to evaluate a company's commitment to sustainability and responsible business practices.

Secondly, it also helps companies identify areas for improvement, driving positive change and fostering long-term value creation. Moreover, ESG reporting is increasingly becoming a requirement for investors and regulatory bodies, indicating a shift towards a more sustainable and socially conscious economy.

The following points will further add clarity to your understanding:

-

Systematic ESG metric measurement and disclosure provide stakeholders with a holistic view of the sustainability performance of organizations, fostering trust and accountability. Standardized information empowers investors, employees, customers, and regulators to make good decisions and identify areas of improvement. Transparency enables tracking progress and drives positive change over time.

-

ESG reporting helps companies identify both risks and opportunities in a rapidly changing landscape. By analyzing environmental, social, and governance factors, organizations gain insights into potential hazards and challenges. This enables proactive risk management and the development of strategies to mitigate these risks.

-

By integrating ESG considerations into their decision-making processes, businesses foster a culture of responsibility and contribute to the transition towards a more sustainable future.

Global regulations mandate comprehensive ESG reporting, compelling organizations worldwide to disclose information on ESG parameters and adhere to regulatory compliance. Organizations must meet these requirements to fulfill their obligations and meet global standards.

The Key U.S. Legislation on ESG Reporting

While the United States currently lacks comprehensive federal legislation mandating ESG reporting, the Securities and Exchange Commission (SEC) has been actively exploring regulatory measures to enhance ESG disclosures. In March 2021, the SEC formed a Climate and ESG Task Force to identify any misleading or incomplete ESG disclosures, ensuring accurate information for investors.

It is important to note that the ESG reporting landscape in the United States is continuously evolving, with discussions and proposals for additional regulations and standardizations underway.

ESG reporting is a non-negotiable requirement today, considering evolving regulations and their vital importance. Striking the right balance between disclosure, data privacy, and integrity is paramount.

Organizations must navigate the complexities, ensuring transparent reporting while safeguarding sensitive or confidential information to maintain trust, protect their reputation, and avoid non-compliance.

But how to balance data transparency and data privacy?

This is the point where redaction jumps in and becomes a necessity for organizations.

Redaction in ESG Reporting: Balancing Disclosure and Data Privacy

To maintain the confidentiality of crucial business information like trade secrets, processes, operations, work style, sources of income, financials, and profits, it is essential to keep them private before any public disclosure.

Consequently, if any of these sensitive details are referenced in ESG reports, they must be redacted in accordance with legal requirements. Organizations must prioritize disclosing the necessary information through the ECG disclosure process while safeguarding the remaining details that could potentially provide a competitive advantage to their rivals.

By carefully concealing sensitive information within ESG reports, companies can protect personal data, safeguard trade secrets, and comply with regulations. Redaction not only preserves data privacy but also promotes trust and credibility, enabling stakeholders to access meaningful information without compromising sensitive details.

Therefore, organizations require an efficient redaction tool to defend organizations against data privacy threats and empower them to disclose ESG reports with confidence.

With numerous redaction software options available in the market, deciding on the right choice and considering the relevant factors can be challenging.

Among the viable options, VIDIZMO Redactor stands out as a reliable solution.

VIDIZMO Redactor: The Optimal Solution for Organizations Meeting Data Privacy Compliances

With its AI features and user-friendly interface, VIDIZMO Redactor empowers organizations to seamlessly redact personally identifiable information (PII) in various types of media, including videos, audio, images, and documents.

.png?width=1910&height=883&name=MicrosoftTeams-image%20(13).png)

-

VIDIZMO simplifies the document redaction process by searching for specific words and phrases containing personal or confidential information within documents saving valuable time and effort.

-

Regular expression patterns can be utilized to efficiently search for and redact different types of numbers, such as phone numbers, social security numbers, and credit card numbers, providing comprehensive data protection.

-

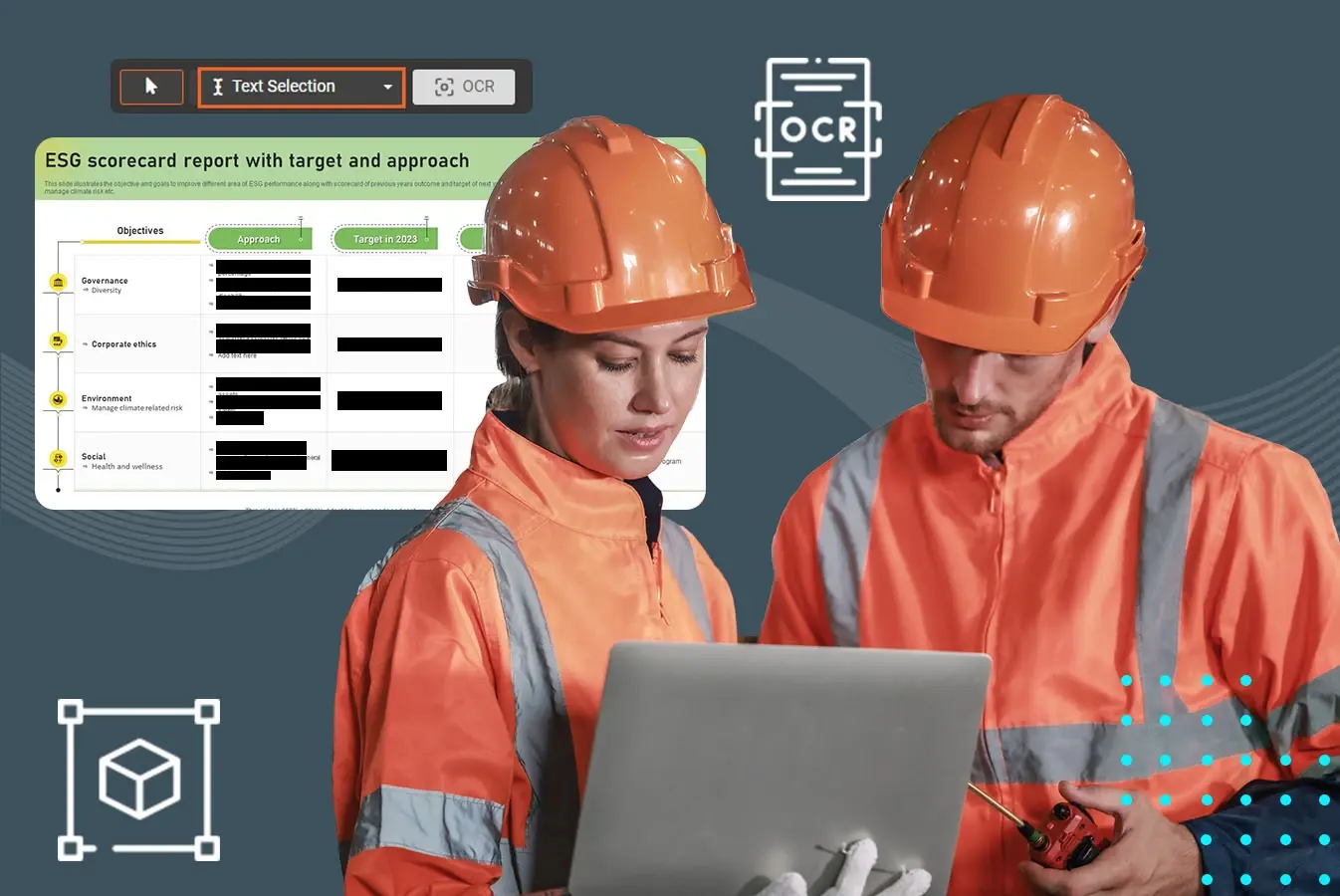

For precise redaction and to generate accurate results, VIDIZMO Redactor offers the flexibility of manual text selection and the ability to draw bounding boxes over the selected text area. This ensures that only the necessary information is concealed, preserving document integrity.

-

Furthermore, the Optical Character Recognition (OCR) functionality expands redaction capabilities to scanned documents, going beyond standard text-based files.

-

Efficiency is paramount when handling a large volume of documents. VIDIZMO Redactor addresses this by allowing the selection of multiple documents for redaction, saving time and effort. This bulk document redaction feature streamlines the process, making it convenient and efficient for organizations dealing with numerous files on a regular basis.

-

Not limited to documents, VIDIZMO Redactor employs AI to automatically detect and redact faces, people, license plates, and even weapons within videos, providing automatic video redaction capabilities.

-

Ensuring the protection of confidential information extends to audio recordings as well. VIDIZMO Redactor includes audio redaction features that allow for muting or bleeping sensitive information within audio call recordings. This ensures that any PII or sensitive details shared during conversations remain private and secure.

Are you interested in knowing more about the redaction capabilities of VIDIZMO?

Closing Remarks

ESG reporting has become a cornerstone for companies seeking to demonstrate their commitment to sustainable practices and responsible business operations. As the demand for data transparency continues to grow, redaction serves as a vital tool in striking the delicate balance between disclosure and data privacy. By carefully concealing sensitive information within ESG reports, companies can protect personal data, safeguard trade secrets, and comply with regulations.

Redaction not only preserves data privacy but also promotes trust and credibility, enabling stakeholders to access meaningful information without compromising sensitive details.

Posted by Sidra Jabeen

Sidra is a Senior Product Marketing Strategist at VIDIZMO. Sidra is actively involved in Research. An expert in Digital Evidence Management System Technologies. For Queries, you can email at websales@vidizmo.com