The difference between PII, PHI, NPI, and PCI

by VIDIZMO Team on November 17,2023

Whether in healthcare, finance, or customer service, organizations handle various types of sensitive information daily, including PII, PHI, NPI, and PCI.

While this data helps them better serve customers, it also makes them shoulder considerable responsibility for keeping it away from prying eyes.

Because, in the wrong hands, this sensitive information can be used for several fraudulent activities like unauthorized credit card usage and tax refunds, identity theft, etc.

Therefore, strict Personal Data Protection protocols are in place to safeguard innocent customers, and compliance is mandatory.

Failure to do so will result in a slap on the wrist to hefty fines; for instance, Sephora USA paid US$ 1.2 million for violating the state's Data Privacy Guidelines in 2022.

Thus, to avoid legal and ethical consequences, it is necessary to understand the distinctions between different data categories.

Protecting customer information should be your top priority regardless of your organization's focus, whether it involves payment card transactions, healthcare services, or any other field.

In this blog, we will review the most common data terms used in breach notifications, including PII (Personally Identifiable Information), PHI (Protected Health Information), PCI (Payment Card Information), and NPI (Nonpublic Information).

If you are stressed for time - jump right to testing our product for free (no credit card required).

What is the Difference Between PII, PHI, NPI, and PCI?

Organizations end up with a considerable amount of personal information, from online shopping to private chats, social media profiles, e-mail correspondences, interactions with customer service departments, visiting the doctor, etc.

This information is subject to strict regulations, and organizations must adhere to specific requirements. They should be aware of:

- How to store personal information

- How to process personal information

- How long they can keep personal information

- To whom can they provide access to personal information

What is PII?

Personally Identifiable Information (PII) is a broad category of data that holds the potential to identify a specific individual uniquely. PII can be defined as any information that, on its own or when combined with other relevant data, can unveil a person's identity.

It encompasses a wide range of personal details, including but not limited to full names, addresses, Social Security numbers, driver's license numbers, passport information, e-mail addresses, and phone numbers.

It also includes other information that gives away one's identity when paired with other data. For example, details like birthdate, race, or gender, when combined, can also count as PII.

What are the Key Types of PII?

PII can be further classified into two categories: sensitive and non-sensitive.

Sensitive PII comprises highly confidential information such as Social Security numbers, financial records, and medical history.

Non-sensitive PII includes data that may be publicly available or less confidential, such as zip codes, gender, and certain demographic information.

It's important to note that certain types of information might not be considered PII when lacking context.

For instance, the mere mention of "John Smith" might not qualify as PII, but in a specific context, say in combination with a Social Security number or address, it transforms into PII.

What is PHI?

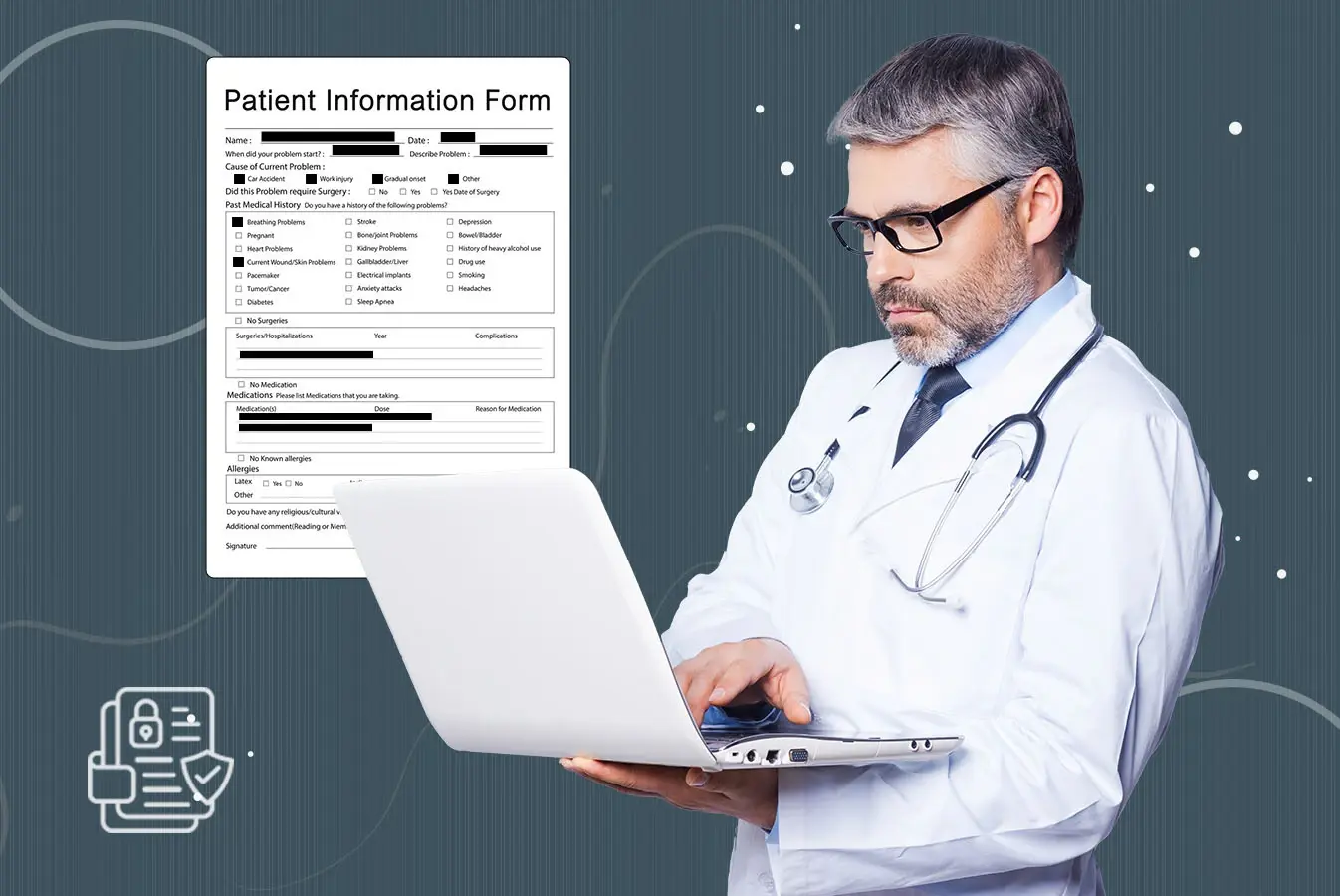

In healthcare, strict rules and regulations are in place to ensure that patient's personal details are kept confidential and secure.

Protected Health Information (PHI) is a subset of Personally Identifiable Information (PII) focusing specifically on health-related data.

PHI is defined and regulated by the Health Insurance Portability and Accountability Act (HIPAA) in the United States.

PHI is any information that relates to an individual's past, present, or future physical or mental health, the healthcare they receive, and the payment for their healthcare.

PHI can include a variety of data, such as medical histories, test results, mental health conditions, insurance information, and more.

What does HIPAA say about PHI?

According to HIPAA, Personal Health Information in Healthcare is any data that includes one or more of 18 specific identifiers. These identifiers can be direct or indirect but associate health information with a particular individual.

Some key identifiers include an individual's name, address (smaller than a state), birthdates, phone numbers, Social Security numbers, medical record numbers, and even biometric identifiers like fingerprints. When combined with health-related data, these identifiers transform that data into PHI.

The importance of HIPAA's regulations surrounding PHI is to ensure the privacy and security of sensitive healthcare information. HIPAA-covered entities, including healthcare providers, insurance companies, and related organizations, must implement strict policies to protect PHI.

However, when all identifiers are removed from a PHI record, it is no longer considered protected health information. This de-identification process allows for sharing of health data for research and other purposes while safeguarding individuals' privacy.

What is PCI?

The Payment Card Industry Data Security Standard (PCI DSS) is critical in safeguarding cardholder data in the financial industry.

Developed and overseen by the PCI Security Standards Council (SSC), PCI DSS offers a comprehensive framework that includes specifications, tools, measurements, and support resources.

Its primary objective is to ensure the secure processing, storage, and transmission of cardholder information, thereby enhancing payment card data security and protecting individuals from card fraud and identity theft.

PCI in the Financial Industry refers to the collective term for organizations and entities processing various payment cards, including credit cards, debit cards, ATM cards, and pre-paid cards.

These organizations play a vital role in facilitating financial data security and ensuring the smooth exchange of funds between consumers and businesses.

PCI Security Standards Council was established through collaboration between major payment card companies such as American Express, Visa, MasterCard, Discover, and the Japan Credit Bureau.

The primary objective of this council is to oversee and uphold the Payment Card Industry Data Security Standard (PCI DSS).

What is PCI Compliance?

Payment card industry compliance means businesses must follow specific rules to keep credit card information safe and secure.

The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized security standard adopted by payment card brands to ensure the secure processing, storage, and transmission of cardholder data.

The PCI Standards Council is responsible for developing the standards for PCI compliance.

Read more about PCI DSS on the VIDIZMO blog: Payment Card Industry Data Security Standard (PCI DSS)

What is NPI?

Nonpublic Personal Information (NPI) is defined by the Gramm-Leach-Bliley Act (GLBA). It pertains to personally identifiable financial information collected by financial institutions in connection with providing financial products or services.

NPI includes various types of data, such as information provided by consumers in applications (e.g., name, address, social security number), data from financial transactions (e.g., account numbers, payment history), and information gathered during the provision of financial products or services (e.g., data from court records or consumer reports).

What is Not NPI?

NPI does not include information that is reasonably believed to be "publicly available." In other words, if steps are taken to verify that data is generally accessible to the public, and the individual has not requested it to remain private, then it is not classified as NPI.

Examples of publicly available information include records made available by the government, widely distributed media (e.g., phone books, newspapers, and publicly accessible websites), and information drawn from publicly recorded sources.

What are the Similarities and Differences between PII, PHI, NPI, and PCI?

PII, PHI, NPI, and PCI are all information regarding Individuals but are slightly different in how they operate.

PII stands for the broader category of personal information, while PHI, NPI, and PCI are specific subsets related to the healthcare and financial sectors.

PCI is part of PII, and the PCI DSS covers PII related to cardholder data. Similarly, PHI is a PII category related to healthcare data privacy, and PHI regulatory compliance covers Personally Identifiable Information in medical records.

It is important to note that personally identifiable information alone isn't automatically categorized as PHI. For example, a person's name can be found in non-health-related situations, and their medical records, which include their name, are consistently regarded as PHI.

The same distinction holds for PII, PCI, and NPI. For example, all PCI and NPI may be considered PII, but the PCI DSS or NPI Compliance does not necessarily protect all PII.

Privacy Law Related to PII, PHI, NPI, and PCI

Understanding privacy laws of PII, PCI, PHI, and NPI is essential for businesses to safeguard individuals' personal information and privacy across various industries, from finance to healthcare and beyond.

Many jurisdictions have strict data protection laws and regulations in place, such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA), The Health Insurance Portability and Accountability Act (HIPPA), PCI Data Security Standard, and Gramm-Leach-Bliley Act (GLBA).

Failure to redact PII, PHI, NPI, and PCI can lead to non-compliance, resulting in legal consequences and potential fines for the organization.

VIDIZMO Redactor for PII, PHI, NPI, and PCI redaction

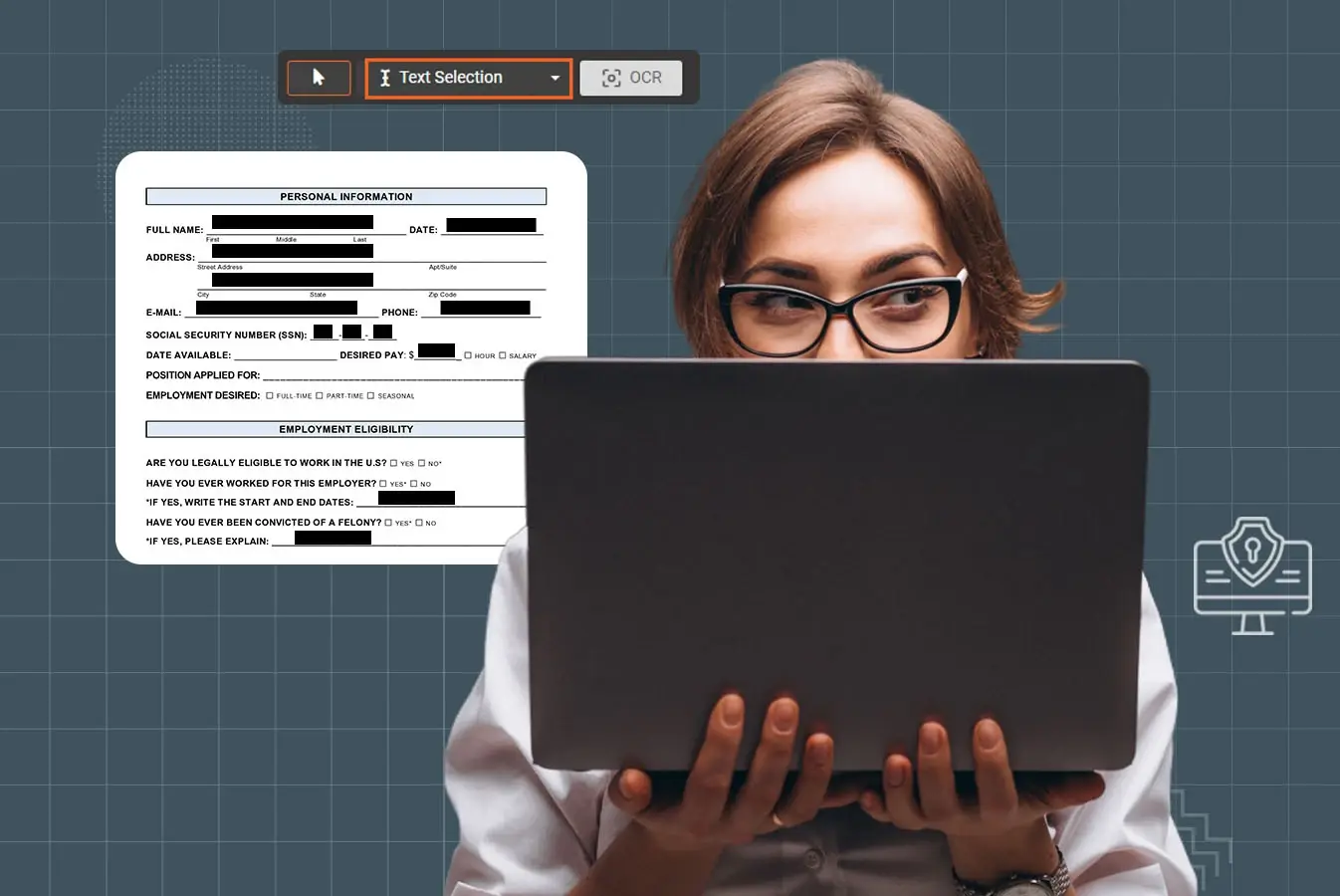

VIDIZMO Redactor unlocks the seamless and secure redaction of PII, PHI, NPI, and PCI through its AI-powered redaction features. The product is widely used in different industries across the globe for secure redaction.

It allows users to redact sensitive information from all types of files, including video, audio, and documents, in bulk.

Once parameters are set, the AI-powered PII redaction automatically detects and redacts all PII in files. It also provides flexible deployment options for organizations to redact PII, PHI, NPI, and PCI securely.

Try it Out!

Overall, understanding the distinctions between PII, PHI, PCI, and NPI is vital in today's data privacy landscape.

Protecting personal information (PII), healthcare data (PHI), financial details (PCI), and nonpublic information (NPI) is critical to safeguarding individual privacy and complying with regulations.

To Strengthen data security and instill trust among stakeholders, consider acting now.

Explore the features of VIDIZMO redactor with a 7-day free trial and begin efficiently protecting PII, PHI, NPI, and PCI in your organization.

FAQs

What do PII and PCI stand for?

PII stands for Personally Identified Information, and PCI stands for Payment Card Industry, which is purposed to provide Financial Data Security. Both these acronyms are meant to ensure Personal Data Protection.

What are the 18 identifiers of PHI?

To ensure Healthcare Data Privacy, the defined 18 PHI identifiers are:

- Patient names

- Geographical elements

- Dates linked to an individual's health or identity

- Telephone numbers

- Fax numbers

- E-mail addresses

- Social Security Numbers

- Medical record numbers

- Health insurance beneficiary numbers

- Account numbers

- Certificate/license numbers

- Vehicle identifiers

- Device attributes

- Serial numbers

- Digital identifiers such as website URLs

- IP addresses

- Biometric elements encompassing finger, retinal, and voiceprints

- Photographs of a patient's face and other identifying numbers or codes

What type of information is PCI?

PCI DSS protects two categories of data: cardholder information and sensitive authentication data. Cardholder data refers to information such as primary account numbers, cardholder names, card expiration dates, and service codes.

What are 3 types of sensitive information?

There are three main types of sensitive information: Personal Information, Business Information, and Classified Information.

Which are examples of PII?

Typical examples of PII include:

- Name: full name, maiden name, mother's maiden name, or alias

- Personal identification numbers: social security number (SSN), passport number, driver's license number, taxpayer identification number, patient identification number, financial account number, or credit card number.

Jump to

You May Also Like

These Related Stories

Understanding PII and How Redaction Software Helps Redact It

Keeping Patient Confidentiality in Healthcare with Redaction Software

No Comments Yet

Let us know what you think